Cost of Sales Formula for Manufacturing

The cost for raw materials is also calculated in a similar method to the beginning inventory. Explore your next job opportunity on Indeed Find jobs Indeed Career Services Salary.

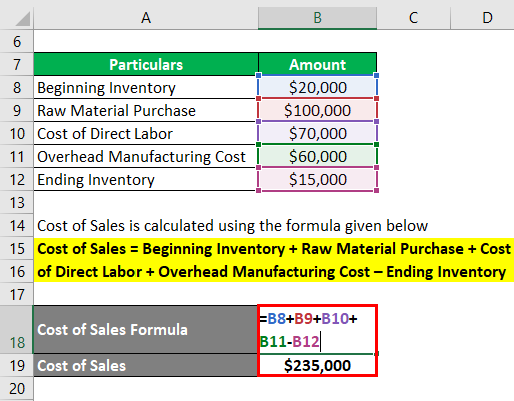

Cost Of Sales Formula Calculator Examples With Excel Template

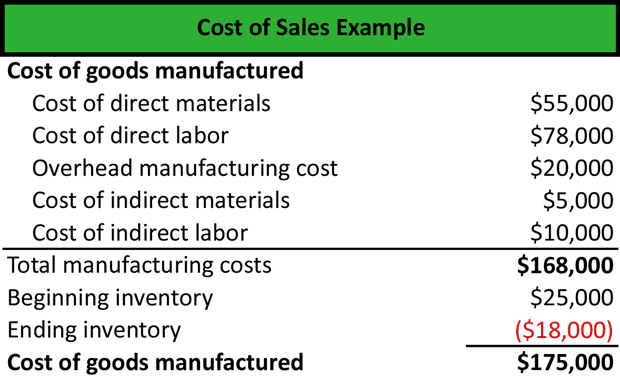

The calculation of the cost of goods sold for a manufacturing company is.

. What is the definition of cost of sales. Cost of Goods manufactured Direct materials cost Direct labor cost Factory overhead cost Opening work in process inventory Ending work in process inventory Cost of goods sold. For example lets imagine.

Cost of Goods Manufactured Total Manufacturing Cost Beginning Inventory Ending Inventory Cost of Goods Manufactured 1 75000 Step 3. Using the cost of goods sold equation you can plug those numbers in as such and discover your cost of goods sold is 33000. The cost of material amount is 80000 for the year The cost of direct labor during the year amounted is 90000 The value of ending inventory amount is 50000 So the formula for.

Cost of Sales Beginning Inventory Purchases Ending Inventory. Hence Cost of Goods Sold can be calculated as. The purchases of stock in trade were Rs 6000 Cr.

Cost of Goods Manufactured. Finally the cost of sales shall be. Cost of Goods Sold Beginning Inventory Purchases during the year Ending.

Cost of Sales Beginning Inventory Purchases Ending Inventory This helps transfer costs to an. Finished Goods Available for Sale. 22000 15000 10000 47000 total manufacturing cost Is this article helpful.

COS Opening Stock Purchases Closing Stock COS 50000 500000 20000 COS 530000 Thus from the above example it can be observed that the cost of the. Ad Browse Discover Thousands of Book Titles for Less. To make a quick calculation for the cost of sales you can use this formula.

Theres a simple cost of sales formula that you can use to calculate your companys cost of sales. You can adjust the cost of the goods purchased or manufactured by the change in. Beginning Inventory of Finished Goods.

You multiply the number of units purchased with the price per unit levied at the. COGS beginning inventory purchases during. Beginning work in process WIP inventory Total manufacturing cost direct materials labor overhead - Ending WIP inventory COGM 150000 75000 105000.

Ad Upgrade your manufacturing software with the ERP built for Custom Manufacturers. The cost of sales formula can be calculated two different ways.

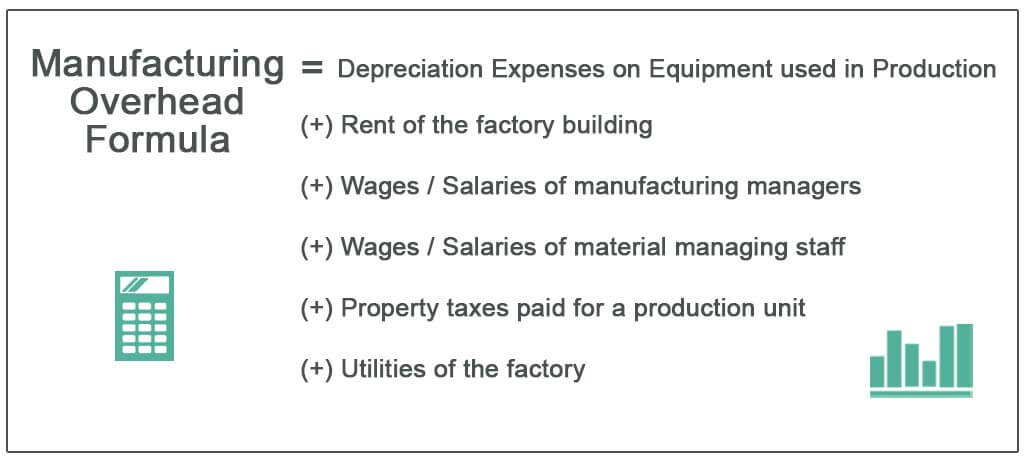

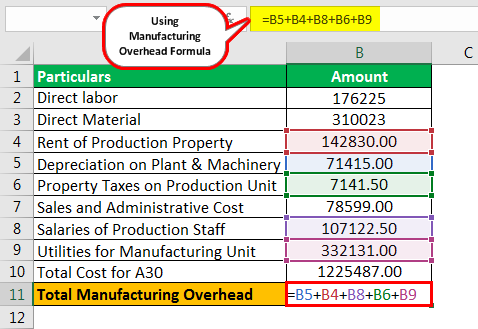

Manufacturing Overhead Formula Step By Step Calculation

Manufacturing Overhead Formula Step By Step Calculation

What Is Cost Of Sales Definition Meaning Example

Cost Of Sales Formula Calculator Examples With Excel Template

0 Response to "Cost of Sales Formula for Manufacturing"

Post a Comment